Diminishing balance method calculator

In this method The depreciation is. 10000 Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000.

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. The double declining balance method is an accelerated depreciation method. It is also known as.

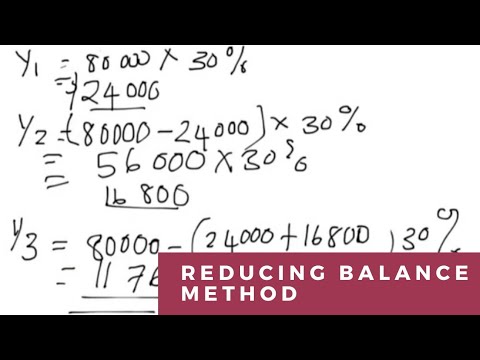

The formula for the Reducing Balance Method can be represented as Amount of interest for each installment Applicable rate of interest Remaining loan amount Suppose a customer takes a. Follow the below steps to calculate depreciation by Reducing Balance Method. If you are using the double declining.

It takes the straight line declining balance or sum of the year digits method. In Diminishing Balance Interest Rate method interest is calculated every month on the outstanding loan balance as reduced by the principal repayment every month. Diminishing Balance Method Example 1.

In the past it. Solution The solution is given below Total cost cost of machinery transportation installation 1500000 175000 75000 Rs. 2000 - 500 x 30 percent 450.

F i r s t y e a r d e p r e c i a t i o n c h a r g e 100000 10 R s. Loan balance can be calculated through the online loan balance calculator. Multiply the book value by the.

As the book value reduces every. Using this method the Book Value at the beginning of each period is multiplied by a fixed Depreciation Rate which. And the residual value is.

The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value. Use the diminishing balance depreciation method to calculate depreciation expenses. R Rate of interest.

Paycheck calculator with 401k deduction The total interest payable calculation is simple. The diminishing balance method is a. The following calculator is for depreciation calculation in accounting.

1750000- Depreciation rate 12. Reducing balance depreciation is a method to help you calculate the rate of depreciation of an asset. The amount remaining to be paid toward an obligation of loan is known as loan balance.

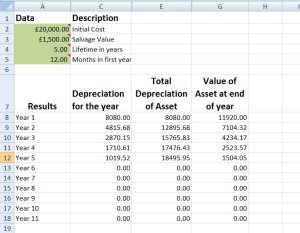

Find the depreciation rate. The Diminishing Balance method is easy to calculate as it only requires the depreciation rate and the net book value of the asset. In Diminishing Balance method of Depreciation we have calculated the depreciation on the closing value of an asset and charge until the book value of an asset will.

2000 - 500 x 30 percent 450. As the book value reduces every year it is also known as the. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets.

Subtract Scrap Value from the Asset Cost. The Diminishing Balance Method is also known as Reducing Installment Method or Written Down Value Method or Declining Balance Method. According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset.

The template displays the. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. This method is a mix of straight line and diminishing balance method.

Find the depreciation rate.

How To Calculate Depreciation Using The Reducing Balance Method In Excel Youtube

Depreciation Formula Calculate Depreciation Expense

How To Use The Excel Ddb Function Exceljet

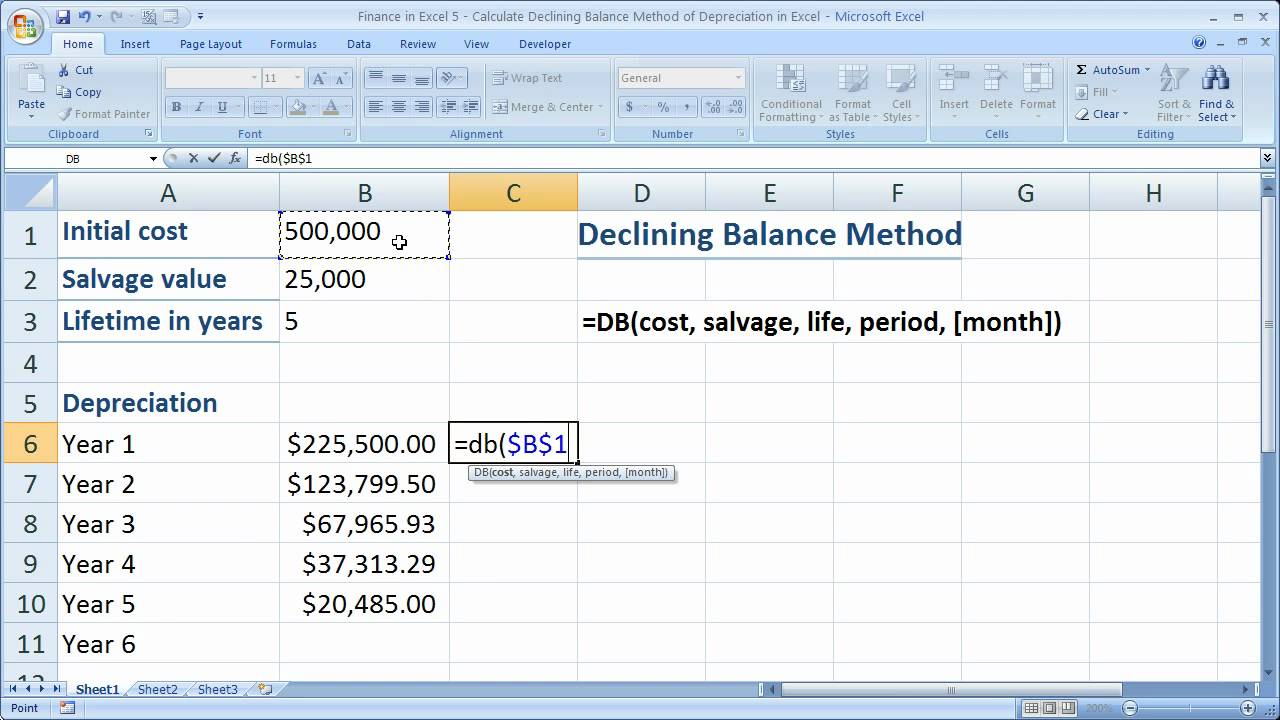

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Compound Interest And Reducing Balance Calculator Vce Geogebra

Double Declining Balance Depreciation Daily Business

Declining Balance Depreciation Calculator

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Archives Page 2 Of 3 Double Entry Bookkeeping

Depreciation Reducing Balance Method Free Calculator

Simple Tutorial Double Declining Balance Method Youtube

How To Use The Excel Db Function Exceljet

Declining Balance Method Of Depreciation Formula Depreciation Guru